- Load the R packages we will use

- Read the data in the file

drug_cos.csvin to R and assign it todrug_cos.

drug_cos <- read_csv("https://estanny.com/static/week5/drug_cos.csv")

- Use

glimpse()to get a glimpse of your data.

glimpse(drug_cos)

Rows: 104

Columns: 9

$ ticker <chr> "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "ZTS…

$ name <chr> "Zoetis Inc", "Zoetis Inc", "Zoetis Inc", "Zoe…

$ location <chr> "New Jersey; U.S.A", "New Jersey; U.S.A", "New…

$ ebitdamargin <dbl> 0.149, 0.217, 0.222, 0.238, 0.182, 0.335, 0.36…

$ grossmargin <dbl> 0.610, 0.640, 0.634, 0.641, 0.635, 0.659, 0.66…

$ netmargin <dbl> 0.058, 0.101, 0.111, 0.122, 0.071, 0.168, 0.16…

$ ros <dbl> 0.101, 0.171, 0.176, 0.195, 0.140, 0.286, 0.32…

$ roe <dbl> 0.069, 0.113, 0.612, 0.465, 0.285, 0.587, 0.48…

$ year <dbl> 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018…- Use

distinct()to subset distinct rows

drug_cos %>%

distinct(year)

# A tibble: 8 x 1

year

<dbl>

1 2011

2 2012

3 2013

4 2014

5 2015

6 2016

7 2017

8 2018- Use

count()to count observations by groups

drug_cos %>%

count(year)

# A tibble: 8 x 2

year n

* <dbl> <int>

1 2011 13

2 2012 13

3 2013 13

4 2014 13

5 2015 13

6 2016 13

7 2017 13

8 2018 13drug_cos %>%

count(name)

# A tibble: 13 x 2

name n

* <chr> <int>

1 AbbVie Inc 8

2 Allergan plc 8

3 Amgen Inc 8

4 Biogen Inc 8

5 Bristol Myers Squibb Co 8

6 ELI LILLY & Co 8

7 Gilead Sciences Inc 8

8 Johnson & Johnson 8

9 Merck & Co Inc 8

10 Mylan NV 8

11 PERRIGO Co plc 8

12 Pfizer Inc 8

13 Zoetis Inc 8drug_cos %>%

count(ticker,name)

# A tibble: 13 x 3

ticker name n

<chr> <chr> <int>

1 ABBV AbbVie Inc 8

2 AGN Allergan plc 8

3 AMGN Amgen Inc 8

4 BIIB Biogen Inc 8

5 BMY Bristol Myers Squibb Co 8

6 GILD Gilead Sciences Inc 8

7 JNJ Johnson & Johnson 8

8 LLY ELI LILLY & Co 8

9 MRK Merck & Co Inc 8

10 MYL Mylan NV 8

11 PFE Pfizer Inc 8

12 PRGO PERRIGO Co plc 8

13 ZTS Zoetis Inc 8- Use

filter()to extract rows that meet criteria. Extract rows in non-consecutive years

# A tibble: 26 x 9

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet… New Jer… 0.222 0.634 0.111 0.176

2 ZTS Zoet… New Jer… 0.379 0.672 0.245 0.326

3 PRGO PERR… Ireland 0.236 0.362 0.125 0.19

4 PRGO PERR… Ireland 0.178 0.387 0.028 0.088

5 PFE Pfiz… New Yor… 0.634 0.814 0.427 0.51

6 PFE Pfiz… New Yor… 0.34 0.79 0.208 0.221

7 MYL Myla… United … 0.228 0.44 0.09 0.153

8 MYL Myla… United … 0.258 0.35 0.031 0.074

9 MRK Merc… New Jer… 0.282 0.615 0.1 0.123

10 MRK Merc… New Jer… 0.313 0.681 0.147 0.206

# … with 16 more rows, and 2 more variables: roe <dbl>, year <dbl>- Extract every other year from 2012 to 2018

# A tibble: 52 x 9

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet… New Jer… 0.217 0.64 0.101 0.171

2 ZTS Zoet… New Jer… 0.238 0.641 0.122 0.195

3 ZTS Zoet… New Jer… 0.335 0.659 0.168 0.286

4 ZTS Zoet… New Jer… 0.379 0.672 0.245 0.326

5 PRGO PERR… Ireland 0.226 0.345 0.127 0.183

6 PRGO PERR… Ireland 0.157 0.371 0.059 0.104

7 PRGO PERR… Ireland -0.791 0.389 -0.76 -0.877

8 PRGO PERR… Ireland 0.178 0.387 0.028 0.088

9 PFE Pfiz… New Yor… 0.447 0.82 0.267 0.307

10 PFE Pfiz… New Yor… 0.359 0.807 0.184 0.247

# … with 42 more rows, and 2 more variables: roe <dbl>, year <dbl>- Extract the tickers “PEE” and “MYL”

# A tibble: 8 x 9

ticker name location ebitdamargin grossmargin netmargin ros roe

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl>

1 MYL Myla… United … 0.245 0.418 0.088 0.161 0.146

2 MYL Myla… United … 0.244 0.428 0.094 0.163 0.184

3 MYL Myla… United … 0.228 0.44 0.09 0.153 0.209

4 MYL Myla… United … 0.242 0.457 0.12 0.169 0.283

5 MYL Myla… United … 0.243 0.447 0.09 0.133 0.089

6 MYL Myla… United … 0.19 0.424 0.043 0.052 0.044

7 MYL Myla… United … 0.272 0.402 0.058 0.121 0.054

8 MYL Myla… United … 0.258 0.35 0.031 0.074 0.028

# … with 1 more variable: year <dbl>Use select() to select, rename and reorder colums.

- select columns

ticker,nameandros

drug_cos %>%

select(ticker,name, ros)

# A tibble: 104 x 3

ticker name ros

<chr> <chr> <dbl>

1 ZTS Zoetis Inc 0.101

2 ZTS Zoetis Inc 0.171

3 ZTS Zoetis Inc 0.176

4 ZTS Zoetis Inc 0.195

5 ZTS Zoetis Inc 0.14

6 ZTS Zoetis Inc 0.286

7 ZTS Zoetis Inc 0.321

8 ZTS Zoetis Inc 0.326

9 PRGO PERRIGO Co plc 0.178

10 PRGO PERRIGO Co plc 0.183

# … with 94 more rows- Use

selectto exclude columnsticker,rows,ros

drug_cos %>%

select(-ticker,-name, -ros)

# A tibble: 104 x 6

location ebitdamargin grossmargin netmargin roe year

<chr> <dbl> <dbl> <dbl> <dbl> <dbl>

1 New Jersey; U.S.A 0.149 0.61 0.058 0.069 2011

2 New Jersey; U.S.A 0.217 0.64 0.101 0.113 2012

3 New Jersey; U.S.A 0.222 0.634 0.111 0.612 2013

4 New Jersey; U.S.A 0.238 0.641 0.122 0.465 2014

5 New Jersey; U.S.A 0.182 0.635 0.071 0.285 2015

6 New Jersey; U.S.A 0.335 0.659 0.168 0.587 2016

7 New Jersey; U.S.A 0.366 0.666 0.163 0.488 2017

8 New Jersey; U.S.A 0.379 0.672 0.245 0.694 2018

9 Ireland 0.216 0.343 0.123 0.248 2011

10 Ireland 0.226 0.345 0.127 0.236 2012

# … with 94 more rows- Rename and reorder columns with

select-start withdrug_cosTHEN -change the name oflocationtoheadquarter-put the columns in this orderyear,ticker,headquarter,netmargin,roe

drug_cos %>%

select(year,ticker,headquarter=location, netmargin, roe)

# A tibble: 104 x 5

year ticker headquarter netmargin roe

<dbl> <chr> <chr> <dbl> <dbl>

1 2011 ZTS New Jersey; U.S.A 0.058 0.069

2 2012 ZTS New Jersey; U.S.A 0.101 0.113

3 2013 ZTS New Jersey; U.S.A 0.111 0.612

4 2014 ZTS New Jersey; U.S.A 0.122 0.465

5 2015 ZTS New Jersey; U.S.A 0.071 0.285

6 2016 ZTS New Jersey; U.S.A 0.168 0.587

7 2017 ZTS New Jersey; U.S.A 0.163 0.488

8 2018 ZTS New Jersey; U.S.A 0.245 0.694

9 2011 PRGO Ireland 0.123 0.248

10 2012 PRGO Ireland 0.127 0.236

# … with 94 more rowsStart with drug_cos then extract information for the tickers AGN, ZTS,BIIB THEN select the variables ticker, year, and grossmargin

# A tibble: 24 x 3

ticker year grossmargin

<chr> <dbl> <dbl>

1 ZTS 2011 0.61

2 ZTS 2012 0.64

3 ZTS 2013 0.634

4 ZTS 2014 0.641

5 ZTS 2015 0.635

6 ZTS 2016 0.659

7 ZTS 2017 0.666

8 ZTS 2018 0.672

9 BIIB 2011 0.908

10 BIIB 2012 0.901

# … with 14 more rowsStart with drug_cos then extract information for the tickers AGN, ZTS, THEN select the variables ticker, netmargin, and roe , change the name roe to return_on_equity

# A tibble: 16 x 3

ticker netmargin return_on_equity

<chr> <dbl> <dbl>

1 ZTS 0.058 0.069

2 ZTS 0.101 0.113

3 ZTS 0.111 0.612

4 ZTS 0.122 0.465

5 ZTS 0.071 0.285

6 ZTS 0.168 0.587

7 ZTS 0.163 0.488

8 ZTS 0.245 0.694

9 AGN 0.057 0.075

10 AGN 0.016 0.026

11 AGN -0.288 -0.147

12 AGN -0.349 -0.085

13 AGN 0.290 0.05

14 AGN 1.01 0.184

15 AGN -0.276 -0.06

16 AGN -0.326 -0.07412 select ranges of columns -by names

drug_cos %>%

select(ebitdamargin:netmargin)

# A tibble: 104 x 3

ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl>

1 0.149 0.61 0.058

2 0.217 0.64 0.101

3 0.222 0.634 0.111

4 0.238 0.641 0.122

5 0.182 0.635 0.071

6 0.335 0.659 0.168

7 0.366 0.666 0.163

8 0.379 0.672 0.245

9 0.216 0.343 0.123

10 0.226 0.345 0.127

# … with 94 more rows-by position

drug_cos %>%

select(4:6)

# A tibble: 104 x 3

ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl>

1 0.149 0.61 0.058

2 0.217 0.64 0.101

3 0.222 0.634 0.111

4 0.238 0.641 0.122

5 0.182 0.635 0.071

6 0.335 0.659 0.168

7 0.366 0.666 0.163

8 0.379 0.672 0.245

9 0.216 0.343 0.123

10 0.226 0.345 0.127

# … with 94 more rows-select helper functions -starts_with("abc") matches columns start eith“abc” -ends_with("abc") mathces columns end with “abc” -contains("abc") mathces columns contain “abc”

drug_cos %>%

select(ticker,contains("locat"))

# A tibble: 104 x 2

ticker location

<chr> <chr>

1 ZTS New Jersey; U.S.A

2 ZTS New Jersey; U.S.A

3 ZTS New Jersey; U.S.A

4 ZTS New Jersey; U.S.A

5 ZTS New Jersey; U.S.A

6 ZTS New Jersey; U.S.A

7 ZTS New Jersey; U.S.A

8 ZTS New Jersey; U.S.A

9 PRGO Ireland

10 PRGO Ireland

# … with 94 more rowsdrug_cos %>%

select(ticker,starts_with("r"))

# A tibble: 104 x 3

ticker ros roe

<chr> <dbl> <dbl>

1 ZTS 0.101 0.069

2 ZTS 0.171 0.113

3 ZTS 0.176 0.612

4 ZTS 0.195 0.465

5 ZTS 0.14 0.285

6 ZTS 0.286 0.587

7 ZTS 0.321 0.488

8 ZTS 0.326 0.694

9 PRGO 0.178 0.248

10 PRGO 0.183 0.236

# … with 94 more rowsdrug_cos %>%

select(year,ends_with("margin"))

# A tibble: 104 x 4

year ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl> <dbl>

1 2011 0.149 0.61 0.058

2 2012 0.217 0.64 0.101

3 2013 0.222 0.634 0.111

4 2014 0.238 0.641 0.122

5 2015 0.182 0.635 0.071

6 2016 0.335 0.659 0.168

7 2017 0.366 0.666 0.163

8 2018 0.379 0.672 0.245

9 2011 0.216 0.343 0.123

10 2012 0.226 0.345 0.127

# … with 94 more rowsuse group_by to set up data for operations by groups

group_by

drug_cos %>%

group_by(ticker)

# A tibble: 104 x 9

# Groups: ticker [13]

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet… New Jer… 0.149 0.61 0.058 0.101

2 ZTS Zoet… New Jer… 0.217 0.64 0.101 0.171

3 ZTS Zoet… New Jer… 0.222 0.634 0.111 0.176

4 ZTS Zoet… New Jer… 0.238 0.641 0.122 0.195

5 ZTS Zoet… New Jer… 0.182 0.635 0.071 0.14

6 ZTS Zoet… New Jer… 0.335 0.659 0.168 0.286

7 ZTS Zoet… New Jer… 0.366 0.666 0.163 0.321

8 ZTS Zoet… New Jer… 0.379 0.672 0.245 0.326

9 PRGO PERR… Ireland 0.216 0.343 0.123 0.178

10 PRGO PERR… Ireland 0.226 0.345 0.127 0.183

# … with 94 more rows, and 2 more variables: roe <dbl>, year <dbl>drug_cos %>%

group_by(year)

# A tibble: 104 x 9

# Groups: year [8]

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet… New Jer… 0.149 0.61 0.058 0.101

2 ZTS Zoet… New Jer… 0.217 0.64 0.101 0.171

3 ZTS Zoet… New Jer… 0.222 0.634 0.111 0.176

4 ZTS Zoet… New Jer… 0.238 0.641 0.122 0.195

5 ZTS Zoet… New Jer… 0.182 0.635 0.071 0.14

6 ZTS Zoet… New Jer… 0.335 0.659 0.168 0.286

7 ZTS Zoet… New Jer… 0.366 0.666 0.163 0.321

8 ZTS Zoet… New Jer… 0.379 0.672 0.245 0.326

9 PRGO PERR… Ireland 0.216 0.343 0.123 0.178

10 PRGO PERR… Ireland 0.226 0.345 0.127 0.183

# … with 94 more rows, and 2 more variables: roe <dbl>, year <dbl>- Maximum

roefor all companies

drug_cos %>%

summarize(max_roe=max(roe))

# A tibble: 1 x 1

max_roe

<dbl>

1 1.31-maximum roe for each year

drug_cos %>%

group_by(year) %>%

summarize(max_roe=max(roe))

# A tibble: 8 x 2

year max_roe

* <dbl> <dbl>

1 2011 0.451

2 2012 0.69

3 2013 1.13

4 2014 0.828

5 2015 1.31

6 2016 1.11

7 2017 0.932

8 2018 0.694-maximum roe for each ticker

drug_cos %>%

group_by(ticker) %>%

summarize(max_roe=max(roe))

# A tibble: 13 x 2

ticker max_roe

* <chr> <dbl>

1 ABBV 1.31

2 AGN 0.184

3 AMGN 0.585

4 BIIB 0.334

5 BMY 0.373

6 GILD 1.04

7 JNJ 0.244

8 LLY 0.306

9 MRK 0.248

10 MYL 0.283

11 PFE 0.342

12 PRGO 0.248

13 ZTS 0.694-find the mean ros for each year and call the variable mean_ros -extract the mean 2016

# A tibble: 1 x 2

year mean_ros

<dbl> <dbl>

1 2013 0.227Find the median ros for each year and call the variable median_ros Extract the median for 2013

# A tibble: 1 x 2

year median_ros

<dbl> <dbl>

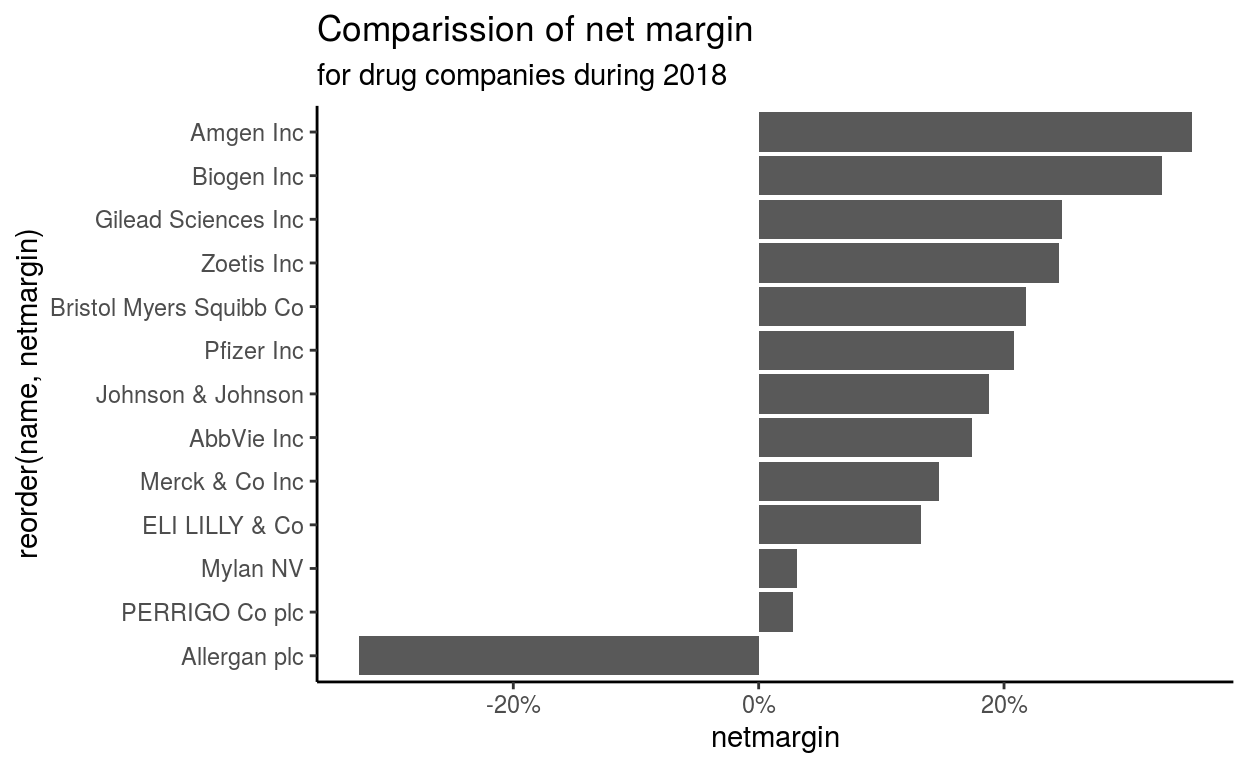

1 2013 0.22416 pick a ratio and a year and comare the companies

drug_cos %>%

filter(year==2018) %>%

ggplot(aes(x=netmargin,y=reorder(name,netmargin)))+

geom_col()+

scale_x_continuous(labels=scales::percent)+

labs(title = "Comparission of net margin",

subtitle = "for drug companies during 2018",

X=NULL, Y=NULL)+

theme_classic()

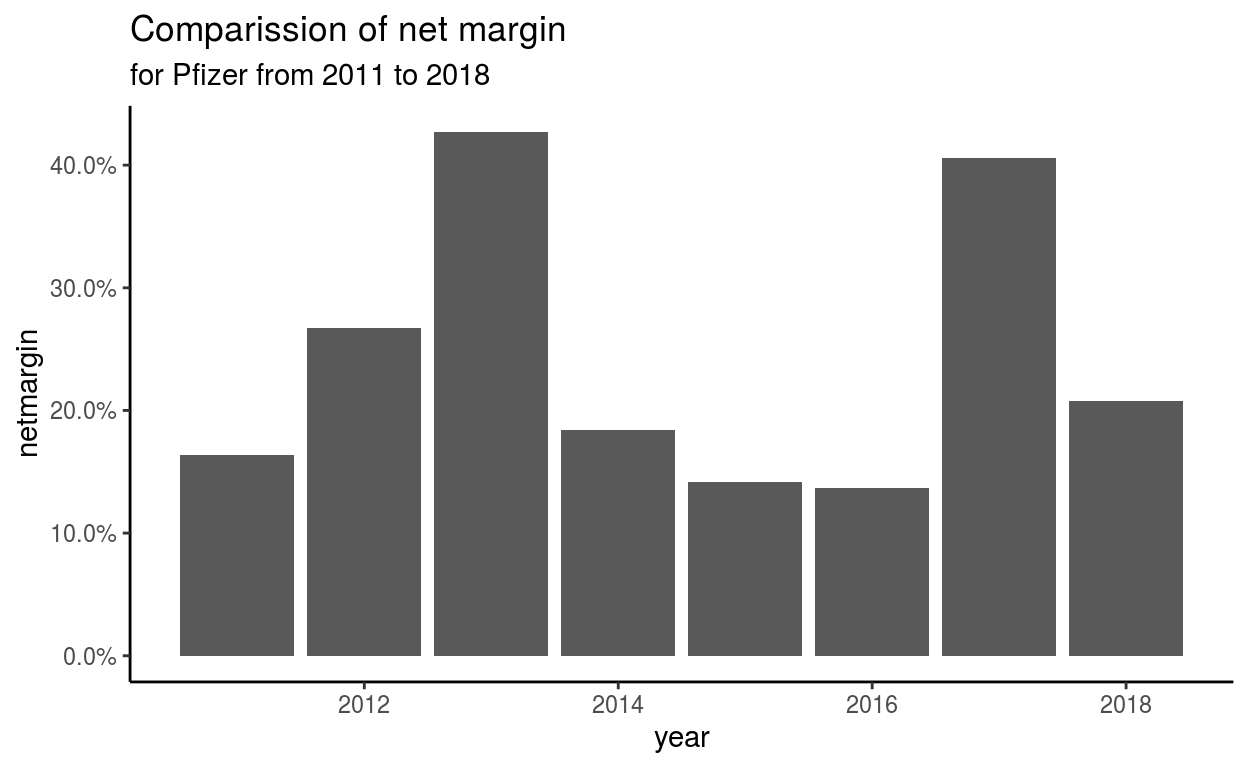

17 pick a company and a ratio compare the ratio over tome

drug_cos %>%

filter(ticker=="PFE") %>%

ggplot(aes(x=year,y=netmargin))+

geom_col()+

scale_y_continuous(labels=scales::percent)+

labs(title = "Comparission of net margin",

subtitle = "for Pfizer from 2011 to 2018 ",

X=NULL, Y=NULL)+

theme_classic()

ggsave(filename = "preview.png",

path= here::here("_posts", "2021-03-09-data-manipulation"))